Click on above image to see full case PDF

David La (along with other family members) owed the State of California more than $1,600,000 in unpaid taxes. Seven La family members, including David, signed an agreement allowing the government to apply an earlier cash seizure totaling more than $200,000 ($237,785 to be exact) to be applied to that debt.

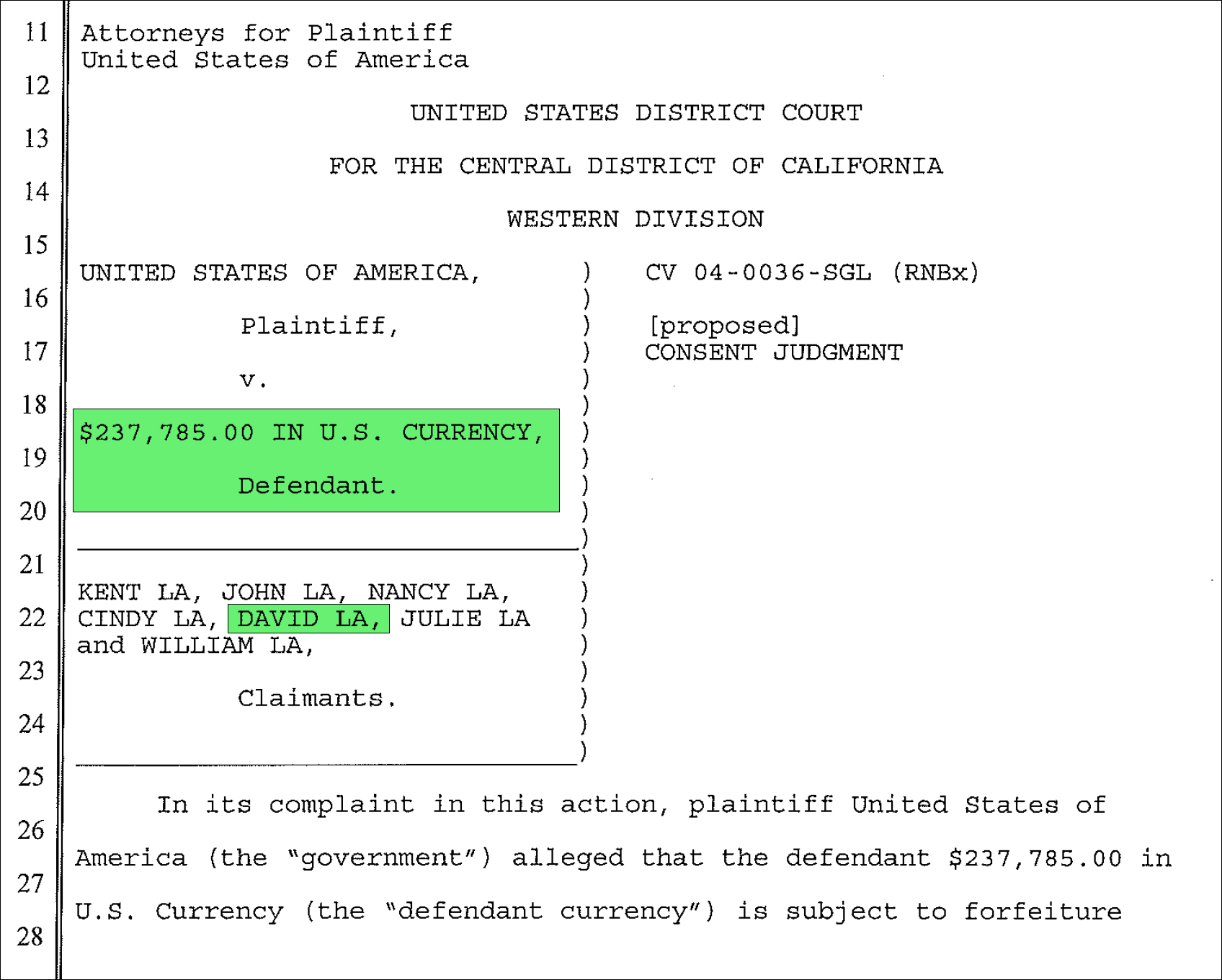

The plaintiff in the case was the United States of America. The defendant was “$237,785.00 in U.S. Currency.” Claimants in the case were David La, Kent La, John La, Nancy La, Cindy La, Julie La and William La.

Confused? Yes, actual U.S. currency can be a defendant in a Federal case.

In this instance, the United States Attorney’s office in Los Angeles were attorneys for the plaintiff, the United States of America.

Quoting directly from the case, here’s how it reads:

“In its complaint in this action, plaintiff United States of America (the ‘government’) alleged that the defendant, $237,785.00 in U.S. Currency (the ‘defendant currency’) is subject to forfeiture pursuant to 18 U.S.C. § 91(a)(1)(c). Claimants Kent La, John La, Nancy La, Cindy La, David La, Julie La and William La (collectively, the ‘claimants’) filed their claims of interest and answers disputing the government’s allegations.”

and

“The parties have agreed to settle this forfeiture action and to avoid further litigation by entering into this consent judgment.”

And later in the case document:

“$29,785.00 of the defendant currency has already been forfeited to the United States.”

“The remaining $208,000 of the defendant currency shall be used toward partial satisfaction of the restitution order in the amount of $1,678,743.30 to the California State Board of Equalization in the State of California v. La, BA 270564.”

Ouch. (Seems to be a familiar refrain in this whole David La/Legends Poker Room mess – our opinion.)